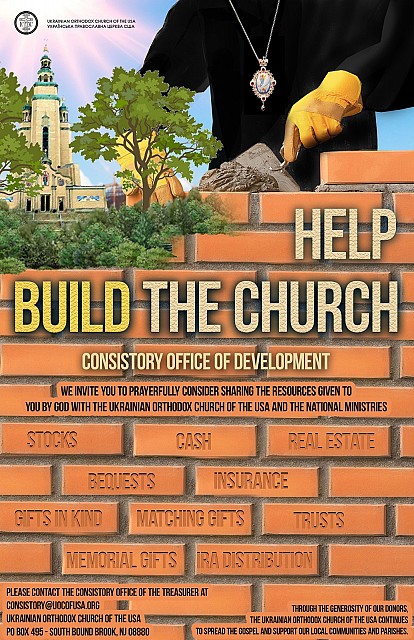

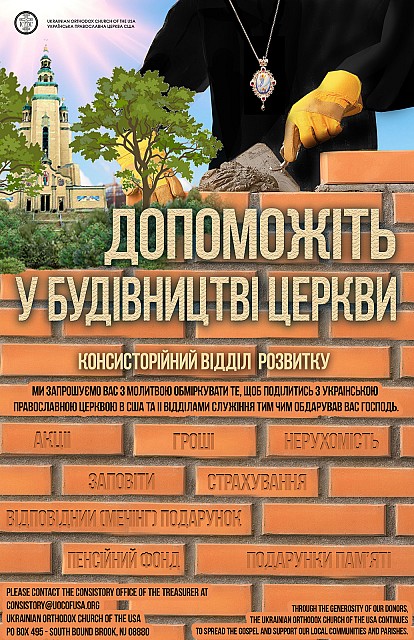

The Consistory Office of Development responds to the spiritual needs of the Ukrainian Orthodox Christian Faithful through National Ministries, providing programs and services to your local parishes and you. We invite you to prayerfully consider sharing the resources given to you by God with a donation to the Ukrainian Orthodox Church of the USA. Your support helps us further the vital ministry work.

About Us

The Consistory Office of Development is a ministry created as a response to Christ’s call to bring people closer to the Church, through raising funds for the Ukrainian Orthodox Church of the USA. Inspired to be the voice of Christ in a changing world, we invite all to share their God given gifts gratefully, responsibly, joyfully and charitably to build the Kingdom of God.

Asking people to share their resources with the Ukrainian Orthodox Church of the USA is an invitation to help spread the Orthodox Christian Faith in America. The initiatives of this Office provide people with the opportunity to fully commit to the Gospel’s call to stewardship. Donations to the UOC of the USA are vital for the growth of the Ukrainian Orthodox Church of the USA.

We invite you to prayerfully consider sharing the resources given to you by God with the Ukrainian Orthodox Church of the USA and the National Ministries.

Opportunities to share treasures given to you by God

Cash - The simplest and most frequently used method of providing support for the Church or any of the Ministerial entities is a through a cash donation. The Ukrainian Orthodox Church of the USA accepts gifts made by check, electronic funds transfer (EFT) or credit card authorization (Visa, MasterCard, Discover and American Express). You may benefit from such gifts with a charitable deduction on your tax return.

Stock - The best stocks to donate are those that have increased greatly in value, particularly those producing a low yield. An outright gift of appreciated securities, or stock, to the UOC of the USA is a quick and easy way to make a meaningful gift, avoid the capital gains tax and receive an income tax deduction for the fair market value of the stock at the time of the gift. Gifting stock held more than 12 months offers a two-fold tax savings. First, you avoid paying capital-gains tax on the increase in value of your stock. Additionally, you receive a tax deduction for the full fair market value of the stock on the date of the gift. Subtracting the tax savings from what you originally paid for the stock can result in a gift that costs just pennies on the dollar. This is an excellent vehicle to make a donation from stock that has appreciated substantially in value. To provide a gift of stock, or if you hold physical stock certificates you would like to transfer, please contact the UOC of the USA Treasurer's Office at (732) 356-0090

Gifts in Kind - Gifts-in-kind (books, works of art, etc.) are deductible at the full fair-market value if they are related to the activities of the Orthodox Church and have been held for more than one year by the donor. Unrelated gifts-in-kind also may be made but will not qualify for a tax deduction.

Matching Gifts - Many employers sponsor matching gift programs and will match any charitable contributions made by their employees. Some companies match gifts made by retirees and/or spouses. If your company has a matching gift program, request a matching gift form from your employer, and send it completed and signed with your gift to the UOC of the USA at 135 Davidson Ave, Somerset, NJ 08873 (PO Box 495; South Bound Brook, NJ 08880). We will do the rest. The impact of your gift to the UOC of the USA may be doubled or possibly tripled!

IRA Distributions - If you are over 70-1/2 years old, you can save on federal and state taxes on your required minimum distribution by setting up a qualified charitable distribution (QCD) from your non-Roth IRA and transferring the funds either partially or entirely to the Ukrainian Orthodox Church of the USA. Contact your retirement investment advisor and set up a QCD for the benefit of the UOC of the USA at 135 Davidson Ave, Somerset, NJ 08873 (PO Box 495; South Bound Brook, NJ 08880).

Memorial Gifts -Memorial gifts are a wonderful way to honor a loved one. Memorial gifts can be made to a specific ministry, the annual Church's Appeal, or for the general use and needs of the UOC of the USA. Gifts should be sent to the Church along with a letter indicating the beneficiary of the gift and the person you wish to remember with your gift.

Planned giving provides donors with a variety of methods to make a lifetime or estate gift to their parish, parish school, various ministry, or the UOC of the USA. Planned Giving has been referred to as an ultimate act of stewardship and a means to establish your legacy by ensuring that your accumulated assets and blessings are distributed to those causes that are important to you.

Planned Gifts can be made during one’s lifetime or as part of an estate plan. Due to the complex and legal nature of many planned giving options, donors are encouraged to always seek legal and professional counsel. The Consistory Office of the Treasurer of the UOC of the USA is available to assist you, your attorney and/or financial advisor in preparing a planned gift.

Bequests: Bequests are one of the most common forms of planned giving. Bequests are provisions in a will for the distribution or transfer of one’s cash or other assets upon death. Bequest gifts may take the form of a specific dollar amount, a gift of stocks or securities, real estate or property, or a percentage of the residue of the estate.

Bequests offer the advantage of making a future gift without affecting your current cash or asset portfolio. When having your attorney draft your bequest, he or she should utilize the following language: "“I give, devise, and bequeath to the Ukrainian Orthodox Church of the USA, a corporation sole with principal offices at 135 Davidson Ave, Somerset, NJ 08873 << insert gift>> for the use and benefit of the Ukrainian Orthodox Church of the USA”

Gifts of Life Insurance Policies: You can make a gift of a life insurance policy by naming the Ukrainian Orthodox Church of the USAS as the beneficiary or co-beneficiary on the policy. This type of gift may be especially attractive since it provides you with the means to make a substantial gift without interrupting your income or disturbing other assets.

Charitable Remainder Trust: With growing concerns over retirement funding, certain types of gifts can provide a source of income during your retirement years. One of the more common forms involves the establishment of a charitable trust. A Charitable Remainder Trust involves transferring a portion of one’s assets into the care of a trustee. The trustee is responsible for managing the trust, making income payments as directed by the donor, and final distribution of the trust’s remaining assets upon termination of the trust.

Donor Benefits: In addition to providing a source of income during one’s lifetime, a Charitable Remainder Trust can help one to minimize the impact of estate taxes and maximize the amount of assets that can be passed along to heirs and charitable causes.

Due to complex legal requirements involving the establishment of a Charitable Remainder Trust, you will need to consult with an attorney and a qualified financial advisor to establish a Charitable Remainder Trust.

For assistance in making a planned gift, please contact the Consistory Office of the Treasurer as follows via e-mail consistory@uocofusa.org or via Regular Mail:

Ukrainian Orthodox Church of the USA

PO Box 495

South Bound Brook, NJ 08880

“Store up treasures in heaven, where neither moth nor decay destroy, nor thieves break in and steal.” Luke 6:20

Through the generosity of our donors, the Ukrainian Orthodox Church of the USA continues to spread the Gospel and support our local communities and parishes.